Maturing Markets, Rising Expectations

Across the Middle East, manufacturers have historically thrived by serving the stable local markets. Unlike manufacturing powerhouses such as China or India, which fuelled industrial growth through export-led strategies, Middle Eastern firms built their business around home-market consumption.

This approach brought stability but also insulation from the competitive pressures of wider markets. Now, under national diversification agendas and a more globalised economy, that local-first model is reaching its limits.

Middle Eastern markets are maturing, and customer expectations are rising in tandem with global standards. Government initiatives – from Saudi Arabia’s Vision 2030 to the UAE’s industrial strategies – are encouraging manufacturers to upgrade capabilities, expand product offerings, and even target export markets. The message is clear: to drive revenue growth in this new era, companies must decisively adapt their products and go-to-market strategies to better fit local preferences and meet world-class benchmarks.

In practice, that means excelling in three key areas: sales & distribution effectiveness, operational efficiency, and robust management control systems.

Three Strategic Levers to Drive Growth

1. Sales & Distribution Effectiveness

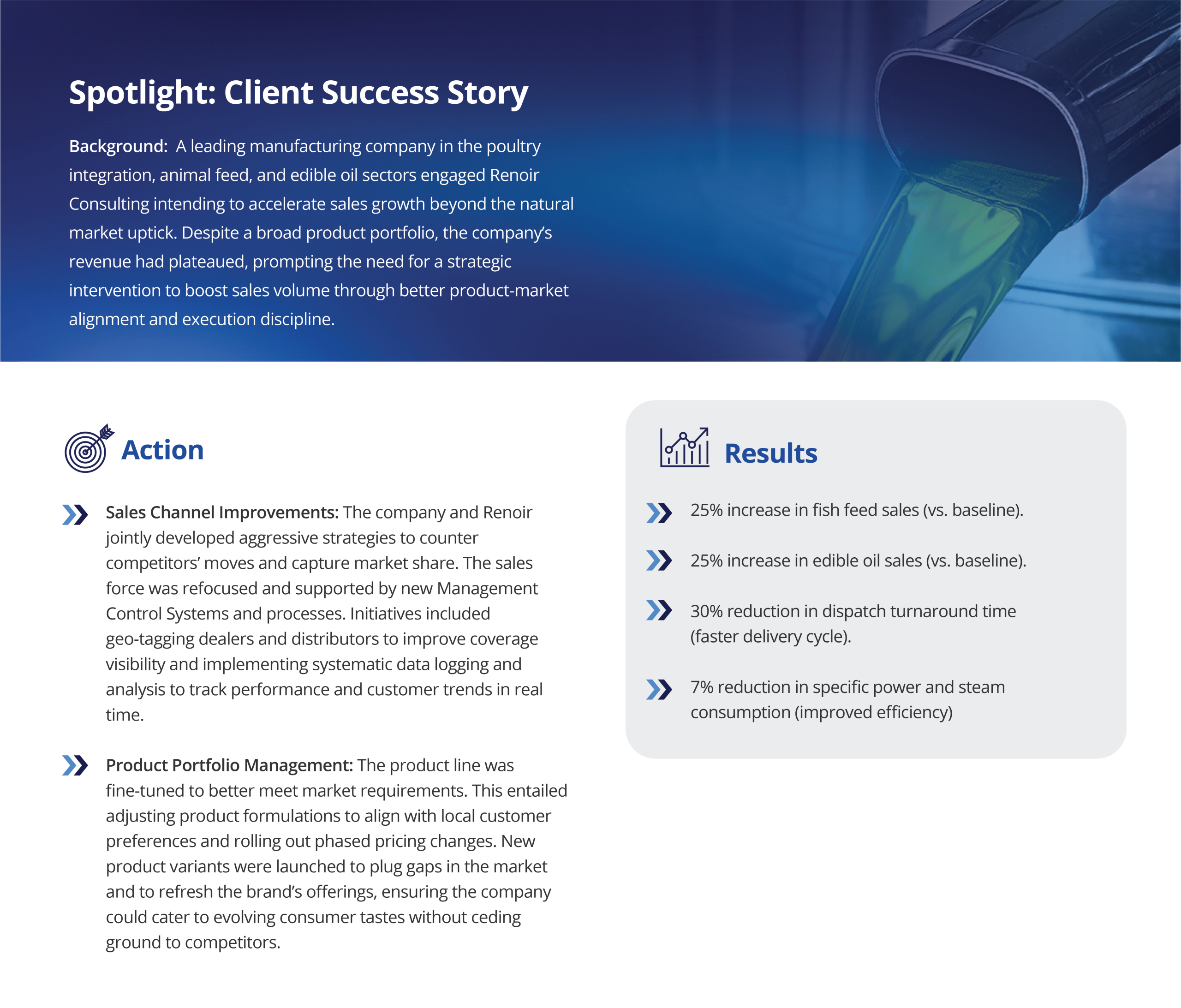

Sales and distribution effectiveness is often the first frontier for boosting revenue. In many Middle Eastern companies, sales teams have not fully penetrated the addressable market, often sticking to existing distributors or passive order-taking. To break this pattern, leading firms should target direct sales in high-margin segments and improve coordination between sales, production planning, and logistics to ensure products are available when and where customers need them.

Equally important is a more granular, data-informed approach to market coverage. Rather than relying solely on broad distributor networks, successful manufacturers employ micro-market mapping to identify underserved pockets. Tools such as competitiveness matrices and channel potential assessments can help companies identify gaps and deepen their channel penetration beyond the usual outlets.

Once new opportunities are identified, disciplined execution is key: instituting daily and weekly sales planning, maintaining rigorous call/visit logs, and holding performance reviews against clear KPIs. These management practices instil accountability and momentum. We have seen some sales teams double their productivity after introducing structured planning and KPI-driven performance reviews.

Ready for a change in your organisation?

2. Operational Efficiency

Optimising internal operations and production processes is crucial not just for cost control, but for enabling revenue expansion. Every inefficiency on the factory floor or in the supply chain is a lost opportunity. It either raises costs (squeezing margins) or slows down output (limiting sales volume). Many Gulf manufacturers still grapple with bottlenecks, inconsistent process discipline, or maintenance issues that constrain their ability to ramp up supply. By systematically tightening operational controls, companies can produce more with the same capacity, allowing them to meet additional demand and even price more aggressively when needed.

Standardising production planning, enforcing robust standard operating procedures, and aligning cross-functional efforts through Service Level Agreements (e.g. between operations and maintenance) create a smoother, more reliable production flow. In turn, higher consistency in output and quality gives the sales team more confidence to push products, knowing the organisation can deliver.

Removing production constraints and instituting real-time floor management (such as live tracking of machine downtime and immediate response mechanisms) can significantly lift throughput. Establishing preventive maintenance routines and continuously logging performance data helps avoid unplanned outages, ensuring that capacity is always available to seize market opportunities.

3. Management Control Systems (MCS)

A robust Management Control System is the backbone of sustained revenue growth. It turns strategic intent into daily execution by harnessing data and disciplined routines. As market conditions shift quickly, manufacturers need real-time visibility into their sales, production, and inventory metrics to make informed decisions.

MCS is not just about software or dashboards; it’s about instilling a culture of data-driven decision-making and accountability. Managers equipped with up-to-date, relevant KPIs can spot emerging trends or problems early – and respond before they impact revenue. Forward-looking metrics (leading indicators) in areas like market demand, production throughput, or supply chain risk serve as an early warning system.

A comprehensive MCS, supported by engaged staff, creates a cycle of continuous improvement. It drives better product fit decisions, higher service levels, and ultimately stronger revenue performance.

Ultimately, aligning product portfolios to the market realities is about leveraging what makes the Middle Eastern businesses strong locally, while adopting the disciplines needed to compete at a higher level. Prioritising domestic strengths, refining product positioning, investing in localised branding, and empowering front-line teams all contribute to increased competitiveness and revenue uplift.

Ultimately, aligning product portfolios to the market realities is about leveraging what makes the Middle Eastern businesses strong locally, while adopting the disciplines needed to compete at a higher level. Prioritising domestic strengths, refining product positioning, investing in localised branding, and empowering front-line teams all contribute to increased competitiveness and revenue uplift.

However, strategies and systems alone do not create growth – management discipline and people engagement do. Real change happens when new processes are embraced on the ground. Renoir’s approach has been to embed this kind of cadence and ownership mindset in client organisations, transferring capability to teams so that improvements not only deliver results quickly but also continue long after the consultants have left.

Renoir’s 30-year global experience (with over two decades on the ground in the Middle East) shows that focused, people-led transformation in these areas can unlock substantial revenue gains of 15–30% within a year, without major capital expenditure.

Achieve breakthrough growth by better fitting products to market needs and by sharpening execution.